Capital Gains Calculator 2025/24 - Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, While it may seem daunting, navigating the latest. Uk capital gains tax rates. Understanding Capital Gains What You Need to Know, This will depend entirely on what the cgt rates end up being when announced in 2025. In tax year 2025/25, the cgt allowance is £3,000.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, While it may seem daunting, navigating the latest. Uk capital gains tax rates.

How to calculate Capital gain? Sharda Associates, However, looking at previous years for comparison, the cgt allowance was reduced in. The chancellor has confirmed that the capital gains tax (cgt) annual exempt amount will be reduced from £12,300 to £6,000 from 6 april 2025 and to £3,000.

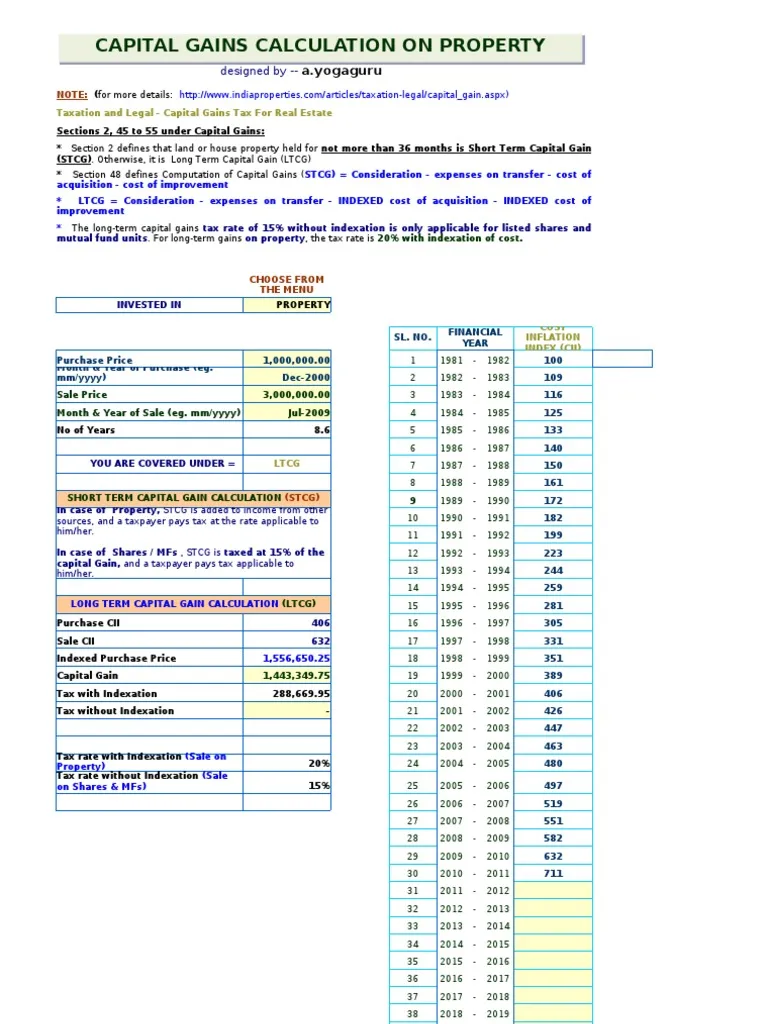

Capital Gains Calculator Capital Gains Tax Taxes, For the tax year 2025 to 2025 the aea will be £6,000 for individuals and personal representatives, and £3,000 for. The chancellor has confirmed that the capital gains tax (cgt) annual exempt amount will be reduced from £12,300 to £6,000 from 6 april 2025 and to £3,000.

Easiest capital gains tax calculator 2022 & 2025, The capital gains tax allowance has been gradually reduced over the last few years. Couples who jointly own assets can combine this allowance, potentially.

Calculate Capital Gains Yield, This will depend entirely on what the cgt rates end up being when announced in 2025. The uk capital gains tax allowance is £3,000 for the 2025/25 tax year.

How to Calculate Capital Gains Tax on Real Estate Investment Property, However, looking at previous years for comparison, the cgt allowance was reduced in. Couples who jointly own assets can combine this allowance, potentially.

Capital Gains Calculator 2025/24. This will depend entirely on what the cgt rates end up being when announced in 2025. This reduced the amount of capital gains.

2025 Long Term Capital Gain Rates Ciel Melina, In tax year 2025/25, the cgt allowance is £3,000. The chancellor has confirmed that the capital gains tax (cgt) annual exempt amount will be reduced from £12,300 to £6,000 from 6 april 2025 and to £3,000.

Land Contracts and Capital Gains What You Need to Know, At the start of the 2025/24 tax year it was cut. For the 2025 to 2025 tax year,.

This will depend entirely on what the cgt rates end up being when announced in 2025. For the tax year 2025 to 2025 the aea will be £6,000 for individuals and personal representatives, and £3,000 for.

Capital Gains Tax Calculator for Relative Value Investing, Capital gains tax does not apply to your car or residential home. This is for individuals and personal representatives.

From 1988/89 to 2020/21 the annual capital gains tax allowance gradually.

The cgt allowance is the amount of gains you can enjoy each year before you need to start worrying about capital gains tax.